MSME Registration in India

MSME Registration In India

MSME industries are the backbone of the economy. They are also known as Small Scale Industries (SSIs). The Government of India provides an MSME registration to the industries classified by the Government as Micro, Small and Medium Enterprises (MSME) in India under the provision of MSME Act 2006.

MSME Classification

The following is the revised MSME classification, where the investment and annual turnover are to be considered for deciding if an entity is considered as an MSME:

Revised MSME Classification

| Criteria | Micro | Small | Medium |

|---|---|---|---|

| Investment & Annual Turnover | < Rs.1 crore & < Rs.5 crore | < Rs.10 crore & < Rs.50 crore | < Rs.10 crore & < Rs.50 crore |

MSME Registration Eligibility

All manufacturing, service industries, wholesale, and retail trade that fulfil the revised MSME classification criteria of annual turnover and investment can apply for MSME registration. Thus, the MSME registration eligibility depends on an entity’s annual turnover and investment. The following entities are eligible for MSME registration:

- Individuals, startups, business owners, and entrepreneurs

- Private and public limited companies

- Sole proprietorship

- Partnership firm

- Limited Liability Partnerships (LLPs)

- Self Help Groups (SHGs)

- Co-operative societies

- Trusts

Documents Required for MSME Registration

The MSME registration documents are as follows:

- Aadhaar card

- PAN card

There are no MSME registration fees and it does not require proof of documents. PAN and GST-linked details on investment and turnover of enterprises will be taken automatically by the Udyam Registration Portal from the Government databases since the portal is integrated with Income Tax and GSTIN systems. GST registration is not compulsory for enterprises that do not require a GST registration. However, enterprises that mandatorily need to obtain GST registration under the GST law, must enter their GSTIN for obtaining the MSME Registration or Udyam Registration.

How to Apply for MSME Registration on Udyam Registration Portal

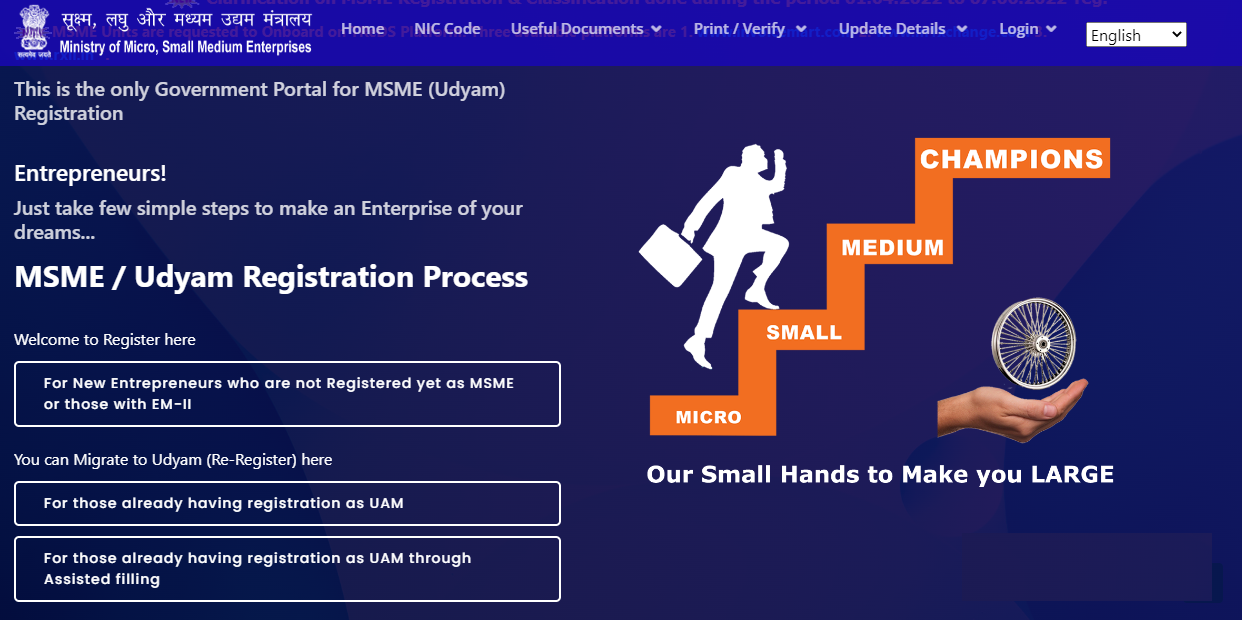

The MSME registration process is entirely online. MSME online registration is to be done on the government portal of udyamregistration.gov.in. There is no MSME registration fee charged for registration. MSME registration online can be done under the following two categories in the portal –

- For New Entrepreneurs who are not Registered yet as MSME or those with EM-II and.

- For those having registration as UAM and for those already having registration as UAM through Assisted filing.

FOR NEW ENTREPRENEURS WHO ARE NOT REGISTERED YET AS MSME OR THOSE WITH EM-II

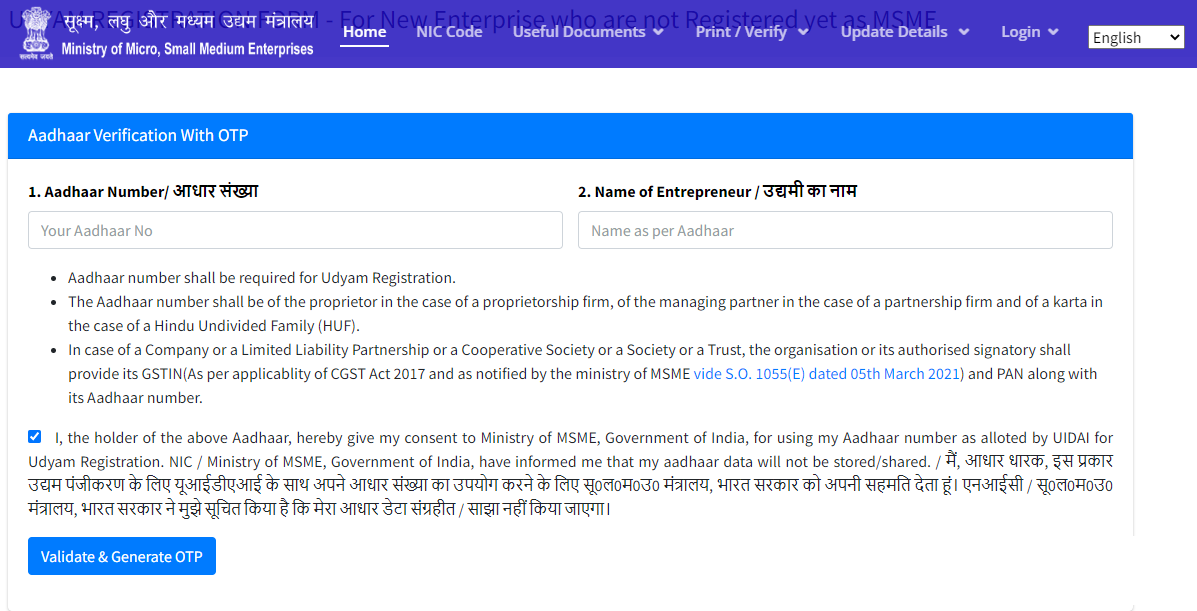

Step 1: New entrepreneurs and entrepreneurs having EM-II registration need to click the button “For New Entrepreneurs who are not Registered yet as MSME or those with EM-II” shown on the home page of Udyam Registration Portal.

Step 2: On the next page, enter the Aadhaar number and the name of the entrepreneur and click on the “Validate and Generate OTP Button”. Once this button is clicked and OTP is received and entered, the PAN Verification page opens

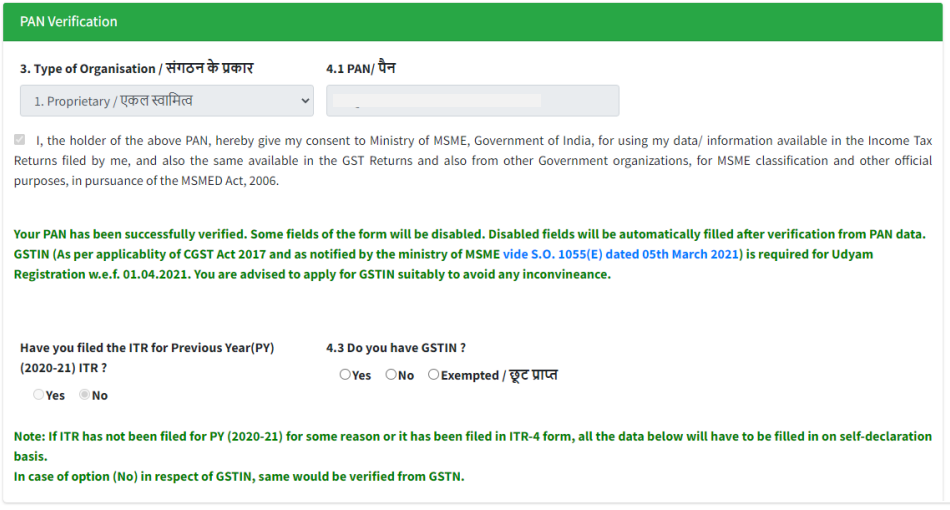

Step 3: The entrepreneur must enter the “Type of Organisation” and the PAN Number and click on the “Validate PAN” button. The portal gets the PAN details from the government databases and validates the PAN number of the entrepreneur.

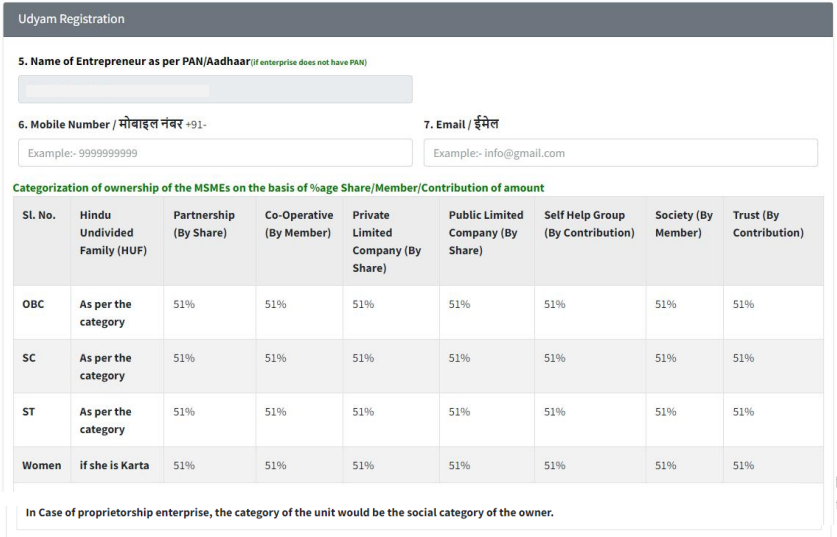

Step 4: After verification of PAN, the Udyam Registration form will appear, and the entrepreneurs need to fill in their personal details and details of their enterprise.

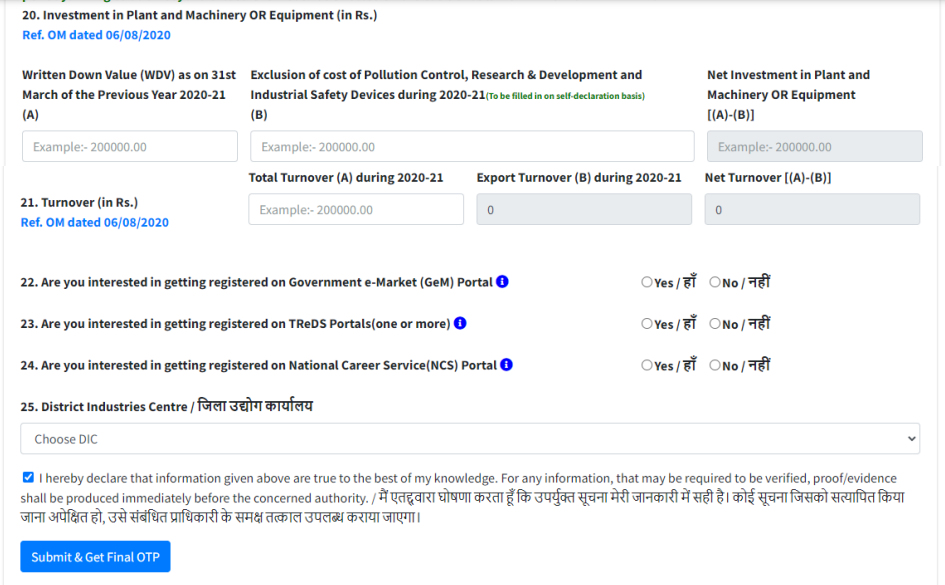

Step 5: Enter the investment and turnover details, select the declaration, and click on the “Submit and Get Final OTP” button. The OTP is sent, and after entering the OTP and submitting the form, the Udyam Registration Certificate will be sent through email. Entrepreneurs can also find out the MSME registration status from the Udyam Registration Portal.

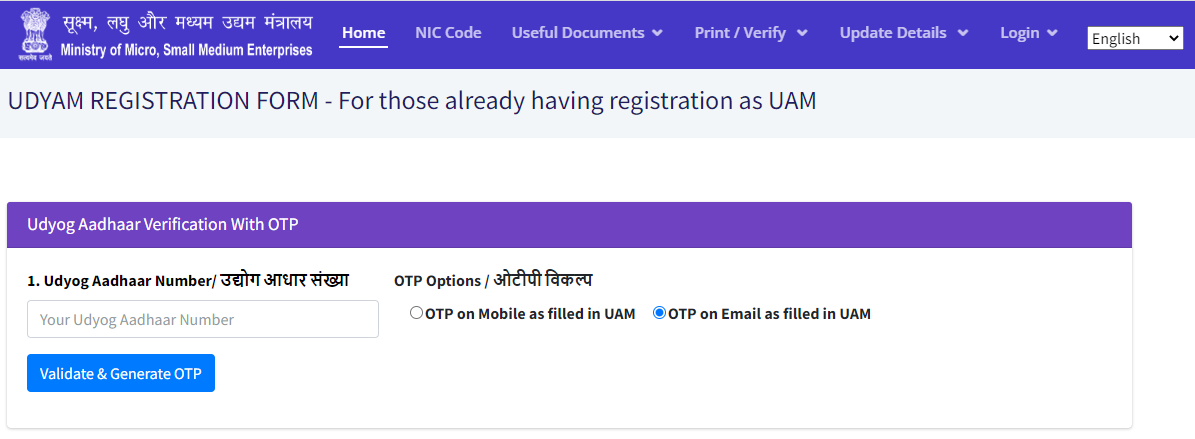

Registration For Entrepreneurs Already Having UAM

For those already having UAM registration, they need to click the button “For those having registration as UAM” or “For those already having registration as UAM through Assisted filing” shown on the home page of the government portal. This will open a page where UdyogAadhaar Number is to be entered, and an OTP option should be selected. The options provided are to obtain OTP on mobile as filled in UAM or obtain OTP on email as filled UAM. After choosing the OTP Options, “Validate and Generate OTP” is to be clicked. After entering OTP, registration details are to be filled on the MSME registration form, and Udyam registration will be complete.